Showing posts with label continued. Show all posts

Showing posts with label continued. Show all posts

Thursday, March 27, 2014

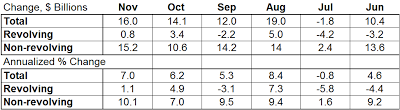

Consumer Credit Continued Strong Growth in November

Consumer credit continued its recent surge in November, rising $16 billion over the previous month’s level. As has been the case for some time, the majority of the growth in consumer credit is driven by gains in non-revolving credit. Consumer credit has now gained more than $10 billion per month for the past four months, after a surprise decline in July.

The gains in revolving credit were relatively modest, gaining $800 million over the month. Revolving credit has been up and down throughout 2012, rising in six and falling in five of the months.

Non-revolving credit continues to drive overall growth, rising 10.1% in November ($15.2 billion). November marks the 15th consecutive gain for non-revolvoing balances. Non-revolving debt growth has been driven primarily by growth in student loans, accounting for 62% of the growth in non-revolving credit on a non-seasonally adjusted basis.

Read the Fed release.

ReadThe RestEntry..

The gains in revolving credit were relatively modest, gaining $800 million over the month. Revolving credit has been up and down throughout 2012, rising in six and falling in five of the months.

Non-revolving credit continues to drive overall growth, rising 10.1% in November ($15.2 billion). November marks the 15th consecutive gain for non-revolvoing balances. Non-revolving debt growth has been driven primarily by growth in student loans, accounting for 62% of the growth in non-revolving credit on a non-seasonally adjusted basis.

Read the Fed release.

Wednesday, March 19, 2014

Service Industry Expansion Continued in December

The service industry continues to improve according to the ISM’s non-manufacturing index. The index improved to a reading of 56.1 in December, its highest level since February. December’s improvement marks the fifth increase in six months. The non-manufacturing index has now remained above 50 – indicating industry expansion – for 36 consecutive months.

The details of December’s report were encouraging as well, with new orders improving to 59.3. The employment index jumped 6.0 points, reaching 56.3, its highest level since march. Export orders improved in December, gaining 1.5 points and presenting a much smaller drag on expansion.

Overall business activity edged lower in December, losing 0.9 points, however remain above 60, an extremely strong reading. Inventories improved slightly in December, however remain below their neutral threshold of 50, indicating a drag on expansion.

Read the ISM release.

ReadThe RestEntry..

The details of December’s report were encouraging as well, with new orders improving to 59.3. The employment index jumped 6.0 points, reaching 56.3, its highest level since march. Export orders improved in December, gaining 1.5 points and presenting a much smaller drag on expansion.

Overall business activity edged lower in December, losing 0.9 points, however remain above 60, an extremely strong reading. Inventories improved slightly in December, however remain below their neutral threshold of 50, indicating a drag on expansion.

Read the ISM release.

Friday, March 7, 2014

Home Prices Continued Improvements in September

Existing home prices appreciated 0.3% in September according to the Case-Shiller’s 10- and 20-city indices. Gains from one year ago accelerated as well, with the 20-city index rising 3.0% above its September 2011 pace, better than the 2.0% year-ago gain reported in August. September’s year-ago gain is the strongest since July 2010.

September’s improvement was widespread geographically with 15 out of the 20 metropolitan areas surveyed reporting month over month price declines. Year-over-year gains improved in most areas surveyed as well, with only 2 reporting declines in prices from a year ago. Phoenix has seen the strongest gains in the past year, with prices 20% above September 2011 levels. Chicago and New York are the only areas that are still reporting year over year declines, however both saw improvement from August.

Despite the recent improvements, home prices remain well below their pre-crisis peak. The 20-city index is still 29.2% below its July 2006 peak.

Read the S&P release.

ReadThe RestEntry..

September’s improvement was widespread geographically with 15 out of the 20 metropolitan areas surveyed reporting month over month price declines. Year-over-year gains improved in most areas surveyed as well, with only 2 reporting declines in prices from a year ago. Phoenix has seen the strongest gains in the past year, with prices 20% above September 2011 levels. Chicago and New York are the only areas that are still reporting year over year declines, however both saw improvement from August.

Despite the recent improvements, home prices remain well below their pre-crisis peak. The 20-city index is still 29.2% below its July 2006 peak.

Read the S&P release.

Subscribe to:

Posts (Atom)