The fiscal cliff agreement has created headwinds early in 2013, resulting in an economy that will grow slowly in the first half of the year before improving to a moderate pace in the second half, according to the Economic Advisory Committee of the American Bankers Association. The committee warns that the tax hikes, a protracted fight over the debt ceiling and the possibility of severe spending cuts in 2013 have the potential to stop our economy in its tracks.

According to the committee, which includes 13 chief economists from among the largest banks in North America, inflation-adjusted GDP growth for the first half of 2013 will be below 2 percent, and is expected to increase to 2.6 percent in this year’s fourth quarter.

The group believes the economy will be shaped this year by the struggle between private sector momentum and the inevitable fiscal drag that comes from the tax and spending decisions made by Congress.

The private sector economy appears poised for sustainable growth. However, the tax hikes made at the start of 2013 will create a drag on GDP growth of at least 1.25 percent, and additional budget cuts from sequestration could further restrain growth.

“If you double down on austerity this year, you’re flirting with recession,” Scott Anderson, committee chairman and Bank of the West chief economist, said. “Resolving the debt ceiling and providing clarity on taxes and spending will boost confidence, opening the door for faster growth at a critical point in the economic expansion.”

While job creation is expected to weaken in the first half of 2013, the bank economists predict that unemployment will continue its slow but steady decline.

“The committee’s consensus is that unemployment will fall to 7.4 percent by year-end,” Anderson said.

The committee sees the housing recovery gaining strength this year, with improving construction levels and rising home sales and prices combining to bolster the housing market in 2013. The committee forecast is that home prices nationwide will rise 4.3 percent and residential investment will increase 12.9 percent.

“Rising home prices create a wealth effect that’s critical to supporting consumer spending and economic expansion,” Anderson said.

According to the committee, consumer spending growth will be positive, but will not improve from last year’s pace. Consumer spending, which represents 70 percent of the economy, is expected to grow only 1.8 percent for 2013 as a whole - about the same as last year.

“We expect consumer spending to slow in the first half of this year as higher taxes reduce consumers’ take-home pay,” Anderson said. “Consumer spending will pick up in the second half of 2013 as housing activity and consumer confidence gain strength.”

While the committee forecasts a slight rise in long-term interest rates, short-term rates will remain exceptionally low in 2013.

“Short-term interest rates are anchored by current Fed monetary policy,” Anderson said. The committee noted that the Federal Reserve has adopted thresholds of 2.5 percent on its inflation forecast and 6.5 percent on the unemployment rate before it would consider raising the Fed Funds rate.

“The committee doesn’t see the unemployment rate falling to 6.5 percent until May 2015,” Anderson said.

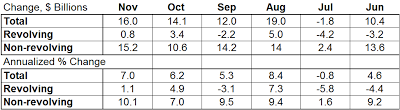

The bank economists forecast that credit growth in 2012 will continue this year. Loans to businesses are expected to grow 6.5 percent in 2013, while loans to individuals are expected to increase 5.0 percent.

“The increase in business lending shows that banks are doing their part to make loans that finance our economy,” Anderson said.

The group sees the federal budget deficit continuing to decline, but remaining at unsustainably high levels. The committee’s forecast is for the federal deficit to fall to $925 billion in 2013 and to $738 billion in 2014 (down from $1.1 trillion in 2012).

“While budget deficits continue to fall, addressing the federal debt as a whole is still a work in progress,” Anderson said. “Much more needs to be done to reduce the federal deficit over the long term.”

The members of the 2013 ABA Economic Advisory Committee are:

- EAC Chair Scott A. Anderson, SVP and chief economist, Bank of the West, San Francisco, Calif.

- Scott J. Brown, SVP and chief economist, Raymond James & Associates, Inc., St. Petersburg, Fla.;

- Robert A. Dye, SVP and chief economist, Comerica Bank, Dallas;

- Ethan S. Harris, co-head of global economics research, Bank of America Merrill Lynch, New York;

- Stuart G. Hoffman, chief economist, PNC Financial Services Group, Pittsburgh;

- Peter Hooper, managing director and chief economist, Deutsche Bank Securities Inc., New York;

- Nathaniel Karp, EVP and chief economist, BBVA Compass, Houston;

- Bruce C. Kasman, chief economist, JP Morgan Chase & Company, New York;

- Christopher Low, chief economist, First Horizon National Corp’s FTN Financial, New York;

- Gregory L. Miller, SVP and chief economist, SunTrust Banks, Inc., Atlanta;

- George Mokrzan, director of economics, Huntington National Bank, Columbus, Ohio;

- Richard F. Moody, SVP and chief economist, Regions Financial Corporation, Birmingham, Ala.; and

- Carl R. Tannenbaum, SVP and chief economist, Northern Trust, Chicago

View detailed EAC forecast numbers.

Having a business of your own is not a piece of cake. It takes real hard work and a concrete motivation to make your dreams come true in the form of new ventures, enterprises and investments. Ideas are bountiful in the minds of any dreamer. But to turn them into reality, it takes a little more than just dreams. You need to be a doer for that and not just a dreamer. To be a doer, a true one, you need an incessant purvey of finances; which does not come easily unless you are from a royal family.

Having a business of your own is not a piece of cake. It takes real hard work and a concrete motivation to make your dreams come true in the form of new ventures, enterprises and investments. Ideas are bountiful in the minds of any dreamer. But to turn them into reality, it takes a little more than just dreams. You need to be a doer for that and not just a dreamer. To be a doer, a true one, you need an incessant purvey of finances; which does not come easily unless you are from a royal family.