Tuesday, April 15, 2014

Unsecured Payday Loans Looking At The Options For Those With Bad Credit

Understanding Your Options

Payday loans are designed to provide borrowers with fast access to cash (generally up to ,500) without the hassle of a credit check. These loans are guaranteed because they are based on simple criteria that most borrowers can meet. Those criteria are:

- The borrower cannot be under 18 years old.

- The borrower must show proof of residence and US citizenship.

- The borrower must have proof of an established job with steady income.

- The borrower must provide the lender with bank account information.

As long as you can meet these eligibility requirements, the opportunity to receive a fast unsecured payday loan is yours. However, there are other options to consider as well.

Can You Qualify for a Secured Loan?

Payday loans are called unsecured loans because they lack any sort of collateral security to ensure their repayment. Theore, issuing an unsecured loan of any type is a huge risk to the lender. To compensate for that risk, the lender will often charge higher rates of interest on these loans, which can make taking an unsecured loan for any length of time a rather expensive proposition.

However, if you own a home or land or even a late model truck or car utilizing the services of a secured loan can off-set a lot of those charges, even with bad credit. In the case of a secured loan, all you do is provide a lender with information about your property (this will generally include an assessment) and the amount of equity that you have in that property. He will then issue you the loan using that property as a guarantee of your repayment. As long as you make your payments without a problem, there is no issue. However, if you fail to repay your loan, the lender will have grounds to seize that property from you.

The use of property as collateral insures the loan from the lenders perspective. This will then allow you to enjoy a lower rate of interest. However, it is important to note that because of the assessment process, it takes significantly longer to receive a secured loan.

Getting a Loan with Little Time

When you are in no position to wait on your loan money, it is best to return to the no credit check option. Because of the lack of credit check, lenders are able to issue payday loans quickly. Once you provide the required information (see above) the lender can issue your loan within 24 hours. As a bonus, the lender will wire the money directly into the bank account that you provide, giving you access to your money quickly no matter where you are located.

Using online lenders will obviously speed up this process and will also give you the ability to compare the different rates and packages offered by several different lenders. Make sure that you research each company before providing them with any of your information, however, and never pay an upfront fee on a unsecured payday loan the application process should be free and easy. If its not, there are many other options available online for borrowers with bad credit.

Removing Collections That Arent Yours From Your Credit Report

Removing collections from your credit report that arent yours is a little trickier than deleting old collection accounts. Many, many, many people claim that collection agency debts arent theirs when, in fact, they are. Disputing a collection as "not mine" is the number one dispute the credit bureaus see, so dont expect to get very far there. Your goal is to convince the collection agency to delete the tradeline of its own volition.

The first thing you do is to write a letter to the company requesting the name and address of the original creditor for the account. You need that information before you begin.

Step One: Sending a Validation Request

This is nothing more than a formality. The collection agency cannot validate an account that isnt valid – but they will. Send a letter to the company, CRRR, requesting that it validate the account. Do not include any other information with your letter, such as "this account is not mine" etc. The collection agency will send you a printout containing the same basic information about the account that you see on your credit report. With any luck, some of that information is incorrect. You want this in writing. It will come in handy later.

Step Two: Calling the Collection Agency

Surprised? You should be. Im normally the first birdie to sing a warning against ever calling a collection agency. In this case, however, it can really work to your benefit. So lets face the beast head-on, shall we?

When you finally get a human being on the line, be polite. Explain your situation honestly, making sure to set yourself apart from the pack as much as possible. I recommend the following introduction:

"Hi, my name is ________. I noticed a tradeline on my credit report recently from your company requesting payment in the amount of _______. The account number for this account is _______. Would you like me to wait while you pull that up in your system?"

This shows both professionalism and kindness. Youre demonstrating those aspects first because you want them returned. Its a heck of a lot harder for a debt collector to start yelling at you about what a deadbeat you are when you start out the conversation on such a civil note. Lets continue..

"I know everyone calls and says this and its probably become so common that it makes you want to scream, (short chuckle) but this debt rightfully belongs to someone else. The name/Social Security number/address/etc. on the tradeline isnt mine. I am willing to do whatever is necessary to help straighten out the situation, both to help myself and to help your company pursue the correct debtor."

You say, "I know everyone says this" to demonstrate that you do know they hear it all the time. By pointing out that you are aware that everybody claims this but in your case its true, you set yourself apart as believable. You chuckle to mark the unpleasant humor of the situation and to add an element of humanity – humanity that you hope will be returned – to the conversation. You also note how helping you also benefits the company to give the collector additional incentive to help you.

The first thing the collector will ask for is your Social Security number. Heres how you respond:

Collector: Can I get your Social Security number please?

You: I mean you no disrespect and I want to get this situation resolved as much as you do, but try and understand my paranoia here about giving out information that can be used against me. After all, any information I give you can be used in an effort to collect the debt – even if those collection efforts are aimed at the wrong individual.

Your goal is to get the collector to tell you who to call to resolve the situation. A special number of a top supervisor, perhaps. The name and address of the person in charge would also be helpful. Any information you can glean from the collector that most debtors dont have access to will help you resolve the situation and stay out of court. Try saying this:

"My goal in calling you today is to get this situation resolved as quickly as painlessly as possible for both of us. Who do I need to talk to within your company to accomplish that?"

If the collector wont help you, call back and try again. Your odds of getting the same representative are low. Sooner or later, someone will tell you who to talk to. Do not let your voice betray any shred of frustration or anger. Unlike most customer service representatives, debt collectors arent trained to be nice at all costs. If you bite, the debt collector will bite back and any chances you had of getting the information you want will go up in smoke.

Once you get an address or e-mail address of someone in a high-ranking position within the company (get the addresses of more than one, if possible. You want to send this letter to as many people as you can) send out a letter asking for help. Im going to provide you with a sample you can tailor to your own situation. The italics in the letter are for your own clarity. Dont include those

Dear Mr./Mrs. ___________

My name is ____________. I am writing to you today with a situation youve probably encountered 1000 times, with only one or two cases out of that thousand being legitimate. I am one such legitimate case. The debt your company claims I owe isnt mine.

I discovered this debt on my credit report with an incorrect name/Social Security number/etc. I requested the name and address of the original creditor for the account and I have never held an account with _______ or I currently hold an account with _________ but it is up to date. I recently requested validation of the account and received a response containing incorrect information. This benefits me, since it proves that your company is pursuing the wrong individual for this debt. I am writing to you rather than simply moving forward with a credit bureau dispute and litigation because I am hoping we can resolve this outside of court.

I am willing to comply with any requests your company has that will prove my innocence in regards to this debt. Please understand, prior to receiving the validation response, I was hesitant to do so because I know that some collection agencies will simply replace the incorrect information with my information in an effort to collect the debt, not caring that they are pursuing the wrong person. I no longer have that fear because the validation I have in writing from your company contains the incorrect data you currently have on file and protects me in the event that data changes. It also serves as proof that the person youre looking for isnt me. Thus, exonerating me is not only beneficial to me, its also beneficial to your company since it frees you to pursue someone who will pay this debt.

Please contact me at (email address) so that we can discuss this matter further.

Sincerely,

Your Name

I know how crazy this may sound to the die hard "Dispute-till-you-drop" camp, but I learned the hard way that collection agencies arent all fire and brimstone. Higher-ups within the company dont depend on commission to pay their bills, and theyre more likely to help you out of sheer human compassion. Given that few people anticipate this from collection agents, the trick works more than youd think.

Once upon a time I had a client whose boyfriend had a collection debt on his credit report that was actually his nephews debt. The two shared the same name and, being ignorant of the way the system normally works, he called the collection agency himself, explained the situation and asked for help. He got it. The collection agent who answered the phone directed him to another employee at the company who was willing to straighten out his file. In the end, my services werent necessary and I was delighted by my clients boyfriends success.

The point being, you might just get the help youre looking for if you ask for it.

If the Collection Agency is No Help Removing An Account That Isnt Yours

Just because the collection agency might help you, that doesnt mean its a certainty. Whether youre dealing with a genuine collection agency or a junk debt buyer makes a significant difference in whether or not you can get the negative report removed from your credit report with a few well-placed telephone calls and letters. Its much tougher to get a junk debt buyer to take you seriously because, if the account is old enough to have been sold to a junk debt buyer, then the debt collectors assume if the debt genuinely wasnt yours you would have already taken care of the problem. In addition, junk debt buyers have a lower successful collection rate that mainstream collectors because the debts they purchase are so much older. This makes them more gung-ho to collect from you, regardless of whether or not you can prove you legitimately dont owe the debt.

Time to play hardball.

Sending An Intent to Sue Letter to the Collection Agency

Remember when I mentioned that collection agencies dont want to go to court? Its normally not worth their time or the money it would cost to defend themselves from consumers – especially when they arent certain just what evidence a consumer has against them until after the discovery period.

Step Three: Sending an Intent to Sue Letter to the Collection Agency

If that collection account on your credit report isnt yours, notify the collection agency of that fact via an intent-to-sue letter. Let the collection agency know, in no uncertain terms, that the entry is incorrect and thus in violation of the FCRA because you never owed the original debt. Dont provide the company with copies of any evidence you have against them. Dont provide anything. You dont want to inadvertently give collectors legal ammunition that can be manipulated and later used against you in court. Just write the letter and point out the following:

- The account isnt yours and was placed on your credit file by mistake.

- You never had an account with the original creditor and you can prove it.

- You can prove that the entry on your credit report contains information that indicates the debt is owed by someone other than you.

- Reporting incorrect information to the credit bureaus is illegal.

- You have the right to sue under the FCRA and you intend to do so unless the entry is immediately removed from your credit report.

And then you wait. With any luck, one intent to sue letter will be enough to convince the collection agency that you mean business and it will delete its negative entry from your credit report.

If the Collection Agency Doesnt Fix Your Credit Report

If threatening to sue the collection agency isnt enough to set a fire under them and get the entry deleted from your credit report, its time to dispute the entry with the credit bureaus. Unfortunately, this is little more than a formality. The credit bureaus validation process is little more than contacting the collection agency with a, "Hey guys, is this correct? It is? Okay thanks." But youll need to prove in court that the collector violated the FCRA knowingly. That means notifying the collector that the information is incorrect before you contest it with the credit bureaus. When the collection agency validates the information as correct, that proves that the company violated the FCRA by knowingly validating an incorrect entry.

And theres always a chance that the entry will get removed. You just never know. Its worth a shot. When the credit bureaus validate the collection that isnt yours on your credit report, its time to take the fight to the courts and sue the collection agency. You could also try the "one-two punch" but Ill write more on that later. For the time being, Im exhausted and this post is long enough as it is. Theres so much information to include. *sigh* Ah well, such is the purpose of a blog. Bit by bit, well get there.

Monday, April 14, 2014

No Credit Check Military Loans Are Available With Instant Approval

For anyone in need of an injection of funds, there is a multitude of loan options out there. When it comes to members of the military, the situation is slightly better, and it is possible to get no credit check military loans approved virtually immediately.

These loans can prove to be a financial lifesaver, but there are some conditions that must be accepted. These conditions relate principally to the limited size of the loan and its term, with a 3-month pay back term typical of such agreements. These factors can affect the total loan sum to be repaid.

However, the advantages in getting a small military loan approved so immediately are clear. But looking at the entire picture, including the small details that are often overlooked, is important in every financial deal.

Loan Limits and Terms

It would be tempting to believe that no credit check military loans are the answer to all financial difficulties that members of the military face. But the truth is that such loans are limited in their size. Most range between $100 to $1,500, which makes them ideal to handle unexpected financial pressures, but not clear large debts.

What is more, the interest rate that is charged is usually much higher than with normal loans, with some lenders charging as much as 30%. The period of time required to repay the loan in full is also quite short. A 3-month pay back term is quite common, and while this means that the actual sum of interest repaid is low, it still places real pressure on the borrower.

This is because, with a $1,500 loan at 30% interest, the total to be repaid is $1,950, making each monthly repayment $650. This is a lot to take out of a monthly paycheck when in financial difficulty. The good news, however, is that military loan deals generally have better terms than civilian loans.

How This Is Possible

The reason a no credit check military loan has better terms than a civilian loan in the same category is the level of security that comes with being paid by the government. Members of the military are assured of an income because the US government is not the same as a business, which might suddenly cease to trade or introduce cost-cutting measures that result in redundancies.

Lenders who offer a 3-month pay back term insist on an automatic repayment schedule direct from the bank account of the borrower. This means that as soon as a salary is deposited into the account, the lender can withdraw the agreed monthly sum. This means that repayments cannot be missed.

The security of the source of income also means that the interest charged on a military loan can be lower, since the risk is so much less. And with so much in favor of this deal, lenders do not hesitate in approving an application - making approval practically immediate.

Basic Criteria To Meet

But, that is not to say there are no basic criteria to meet. Even for no credit check military loans, applicants must qualify and failure to do so means they cannot hope to be approved.

First and foremost, the applicant must be over 18 years of age and be a member of the US military. They must also have a working bank account from which to withdraw monthly repayments as per the 3-month pay back terms.

And remember, repaying these military loans in full on time will see credit ratings improve, while failure to repay will result in a worsened credit history.

Credit Repair Before Or After

In order to understand what follows it is important to give a general idea of what debt consolidation and credit repair effects are. Both a debt consolidation and credit repair process have implications on each other and thus a correct combination of both in terms of time and opportunity can produce the best outcome and achieve the most advantageous results which is what everyone wants when undertaking such processes.

Debt Consolidation Effects

Debt consolidation produces several effects that can alter a credit repair process. For starters, depending on the strategy used, the amount of creditors may be reduced. If the process implies a debt consolidation loan which is used to repay all or the majority of the outstanding debt, then, all the creditors (or most of them) will be replaced by the new lender and thus, though some entries on your report may remain, from now on, you have a fresh start on your credit history.

If a debt consolidation loan is not the way to go, debt consolidation will imply only negotiations with current creditors to reduce debt and agree new repayment programs. Debt consolidation when it implies negotiation can also include the removal of negative entries on the credit report. In any case, the debt reduction alone will improve your credit score and history. However, certain debt consolidation agencies chose to default on several loans and lines of credit prior to negotiations in order to obtain better results and this implies new bad entries on your credit report.

Credit Repair Programs Effects

Credit repair programs have different effects depending on the stage of the program. At first, unfortunately, credit repair programs tend to make the applicants credit score to drop to lower levels than the ones before joining the program. This is mainly due to the fact that credit repair programs often imply the interruption of payment of certain debts to make room for negotiations.

At a later stage, on the other hand, your credit score will continually increase as negative inputs on your credit report keep getting removed by creditors or by the mere pass of time. The interaction of credit repair programs and debt consolidation programs is not unpredictable. Moreover, there are agencies that provide both services.

The combined efforts of credit repair and debt consolidation can get you back to a good credit and financial stance in as little as two years. For some this may sound as a long time but let me assure that it is not. Investing two years time and efforts will result on a good credit score and access to all financial products available for those that never had bad credit. Thus, the answer to the question asked at the beginning of this article is simple: neither before or after, at the same time.

Sunday, April 13, 2014

Credit Scores Payment Choice and Durbin

The study looked at the relationship between credit scores and consumer payment choices. It found that even when controlling for several variables that affect payment behavior, consumers with a higher credit score have a higher probability of holding a credit card, and a lower probability of holding a debit card. Moreover, cardholders with higher credit scores were found to use credit cards for a higher share of their payments and use debit cards less.

The study postulates that if financial institutions attempt to recoup forgone interchange revenues due to the Durbin amendment by charging a debit card fee, consumers with low credit scores are more likely to be harmed by a debit card fee. Low credit score consumers -- who tend to be younger, less educated and lower income -- use debit cards more intensively than those with high credit scores because their access to alternative means of payment is restricted.

Read the paper.

Wednesday, April 2, 2014

the Best Loan for bad credit debt consolidation

Remember that the bank in May

Not everyone is free, and these days very quickly. Compare prices online debt consolidation is so active and unsecured debt consolidation loans are designed to help people with bad credit to pay off with a consolidation loan. Naturally, the best solutions to debt. However, you do not be offered a bid, you will also have the chance of your debts in May to reject your application for consolidation loans because of bad loans in the loan lender will be your salvation in This will give You made your mind, and theore can offer lower prices. A mortgage loan, inance mortgage or secured loan as collateral for the lender can serve as a mortgage or home equity?

Secure against unsecured debt consolidation loans

Taking a loan from a creditor, including the risk of loan. If you have nothing to lose! This particular problem.

Compare quote online debt consolidation for the interest rate offered to more interest on the loan, especially when it will eventually help to eliminate your house to make sure to maintain a tighter budget. If you Get debt consolidation loan bad credit by comparing the different companies for the best rate

Enjoy the competition. Although although you will be too difficult! Bad credit rating shows a high interest rate should be. Some aid - should not know what type of inability to repay loans. Thus, the lender may require more than avoid inadvertently scammed. Get an unsecured personal loan or home loan secured debt consolidation. You have assets that can use as collateral, and decided to reduce the lowest possible rate.

Tuesday, April 1, 2014

Collection Agency Re aged Derogatory Information On Credit Report

How Debt Collectors Re-age Debts

|

| You may end up waiting longer than 7 years... |

The Fair Credit Reporting Act dictates that most debts can only remain on your credit report for 7 years and 180 days from the date of first delinquency. The date of first delinquency is the date that your payments to the original creditor were first classified as late.

What many debtors dont realize is that the DOFD applies to all entries for a given debt. Because few creditors send accounts to collection agencies until they are 180 days delinquent, collection agency entries rarely remain on debtors credit records for the full 7.5-year period. The absolute latest a collection account should disappear is at the same time as the original creditors charge-off. In other words, it simply isnt legal for a collection agency to leave derogatory information on your credit report for longer than the original creditor.

SOL and the Credit Reporting Period

Dont confuse the statute of limitations for lawsuits with the credit reporting periods statute of limitations. These are two totally different time frames. The statute of limitations for lawsuits ers to the amount of time a debt collector can legally sue you in your state. Each state has different statutes of limitations. The credit reporting period – 7.5 years – is federally mandated and the same in every state. Generally the statute of limitations for lawsuits expires long before the credit reporting period.

This is covered in more detail here: The Credit Reporting Period vs. the Statute of Limitations

Re-aged Collection Accounts

If you pull your credit report and the original creditors derogatory information is gone but a collection agencys negative trade line lingers on your report, theres a good change the collector re-aged your debt.

|

| Re-aging sets back the clock on your debt. |

When a debt collector re-ages accounts, it reports a date of first delinquency that is much later than the actual DOFD. In the above example, our DOFD was January of 2005. The collection agency gets the account in June of 2005. If the collection agency reports the date of first delinquency as the date it received the account – in June – the derogatory information will remain on your credit report until June of 2012, rather than being removed in January of 2012, as federal law dictates it should be.

Although clearly illegal, this nasty little trick is incredibly common. I see it literally All. The. Time. A collection agency that regularly alters the dates on its accounts could theoretically ensure that a collection account remains on your credit report indefinitely.

What To Do About Re-aged Collection Debts

Removing a re-aged collection account from your credit report is much easier if you have proof to back up your claim of re-aging. This is one reason I recommend that all individuals print out their credit reports from each credit bureau once each year. The dates lected in the original creditors trade line prove your claim of re-aging – but thats much harder to do once the original creditors trade line ages off your account. Most credit card companies dont keep charge-off records longer than 18 months, so getting proof from the original creditor after the fact is difficult, if not impossible.

If you have proof, send it to the credit bureau along with a letter explaining that the collection account is obsolete and should have been deleted, as the 7.5 year period for that particular debt has already passed. Make sure to use the word "obsolete" in your dispute. Disputes are coded and while I wont get into that right now, I will say that you want your dispute to have the "Obsolete" code.

You can also take your re-aging issue up with the collection agency itself. A well-written "I have every right to sue you" letter along with proof of the re-aging is often enough to coerce debt collectors to remove derogatory information from your credit report. Make sure you point out that you want the trade line deleted. Anything less is against federal law.

Monday, March 31, 2014

Bad Credit Home Loans From Wells Fargo

Wells Fargo Range of Operations

It offers a variety of financial instruments to its clients including, some with rather esoteric names: The Jumbo Mortgage. The Reverse Mortgage. The Adjustable Rate Mortgage. It is the most visible lender financing newly constructed houses in the U.S. It will even go out of its way to structure a home loan program suited directly to the individual home buyer. If you are an employee of a Fortune 100 company, chances are your relocation (and your new housing) with your company was handled by a Wells Fargo representative.

Wells Fargo Home Loan Services

Wells Fargo has earned its reputation by providing some of the best financial instruments for its clientele, especially in the mortgage markets. Its services are fast and reliable, they are solutions oriented, and the application process is free of bureaucratic dead ends that slows down other mortgage servicers. Some of its competitively priced home loan products include:

New Construction F

Home Equity Loans

First Time Buyers Program

Timed Withdrawals (Cued to Repayment Cycles)

Wells Fargo Bad Credit Home Loan Services

Wells Fargo is aware that these troubled times have caused more than a few folks to take some hits on their credit histories. If a consumer with poor credit was to shop around, he or she would find that Wells Fargo has the most opportunities to offer such borrowers. And the consumer would also find that the prices or the interest rates on their products are competitively, and often lower, priced than other bad credit home loan mortgage servicers. Among its many programs you will find:

Closing Guarantees

Wells Fargo organizes closing guarantee loan plans that go far in easing uncertainties in the purchase of housing real estate for borrowers with poor credit histories.

Credit Counseling

Credit management programs are conducted for customers with a not so impressive credit history to help them boost their scores and thereby get a better home loan deal.

Loan Counseling

A great service for first time home buyers, Wells Fargo functions with a commitment to provide responsible servicing to customers by offering a step by step guidance through loan processing. This could be called hand-holding, but it is a definite plus for first time buyers who also have poor credit.

Wells Fargo Expands

To expand its base and thereby increase the services and benefits offered to its clientele, Wells Fargo bought a leading mortgage giant, Wachovia Corporation. The deal was approved by the federal government and was signed during the second week of October 2008. With this merger, Wells Fargo emerges as one of the leading top mortgage companies with the best customer services and policies, and a commitment to offer the best bad credit mortgage solutions to meet the rising and increasingly complex financial requirements of its customers.

Saturday, March 29, 2014

Non Profit Credit Card Debt Consolidation Getting Serious Help

When this happens, most people think about turning to credit card debt management companies that advertise their services on television and in other locations. These companies do not really help individuals on a long term basis. Instead, they help them get of the debt they are currently buried under. In a few short years, the same people will probably need the assistance of these companies again for the same reasons. That means that these companies will continue to make earnings off of people who make the same mistakes time after time.

Instead of calling the first service that advertises their assistance on TV, why not get out your phone book and look up the number of a non-profit credit card debt consolidation organization. That way, you can get the help you actually need.

With a non profit credit card debt consolidation organization you will get honest answers and they will sit down with you and show you all of the numbers involved in non profit credit card debt consolidation and then they also have to show you what they will be charging you every month to do the service.

Every debt consolidation service charges a fee it is just that the other services never tell you how much that fee is while a non profit credit card debt consolidation service will tell you and they will work with you to help you find a way to get your debt under control. You can also expect a non profit credit card debt consolidation organization to ask you a lot of questions so that they can better help you get your life under control. They may not be able to get you any better deals than the regular debt management companies but non profit credit card debt consolidation organizations will at least keep you involved.

Now The Bad News

If you are a qualified debt consolidation manager which organization would you work for? You would probably work for the one that pays the most, right? A non profit credit card debt consolidation organization can have a difficult time attracting good talent because they do not pay well and in the financial services industry, as you can imagine, money means everything.

If, while receiving assistance from a non-profit debt consolidation service, you feel uncomfortable with your debt manager who is working with you, you can decide to get assistance from another service. Make sure that you ask lots of questions and that you understand exactly what will be done in an effort to fix your finances.

About the Author

Are you never able to pay off credit card bill at the end of the month? Find out how to get your debt paid off faster - starting right now - at the Debtopedia website. Visit http://www.debtopedia.com to get your free copy of my special report "Secrets of Credit Card Debt" now.

Friday, March 28, 2014

Getting a 10 000 Car Loan With Bad Credit Some Aspects to Consider

All that must be done is to purchase your own credit report and see where the breaks in your armor lay. There is a small fee to pay, however when getting ready to make use of for big car loans, this might be a worthwhile financial investment.Because long since all of the fundamental criteria are really in order, the variety of issues with the level is very little. But the credit score can generally be improved, through either getting the scores evaluated or perhaps taking away some loans and additionally repaying them off quickly. A A series of 3 or 4 small payday loans are a definite best example. With the achieve improved, automobile loan affirmation despite poor credit turns out to be more likely.Terms to Look Out ForThe specific terms and conditions of any vehicle loan definitely will vary according to the loan provider, however online tend to be some fundamental concepts which must be expected. For a start, getting a $10,000 automobile loan alongside poor credit is certainly not will be attained by insisting in the lowest interest rate and additionally best possible terms and conditions. The fact is the lower the credit get, the higher the speed of interest, as well as theore the higher priced it should be.With large vehicle loans, the number of regular repayments is important since the main sum definitely will be separated up appropriately. Logically then, the longer the term of the loan the lower the regular repayments.

So, a $10,000 loan repaid over 36 months might possibly represent regular payments of around $350, including interest. Only one loan over 60 months, however, may price $250 monthly.The interest rate is important in this, of course, which describes why having the lowest possible credit score helps. It is usually worth looking a 12 months to get car loan affirmation, despite poor credit, throughout the needed sum than moving rather quickly as well as qualifying for too minimal.Exactly how To QualifyJust like just about any loan, getting a $10,000 car loan alongside bad credit is really much dependent in meeting some fundamental criteria 1st. Lenders definitely will not even consider some kind of individual if they are not able to prove they might be over 18 years of age, have a regular income and also (often) are a citizen of the You. Online creditors also assert that applicants have a reside bank account, and offer information so as to deposit the loan (if approved) and arranged direct automatic payments.It is only one for large car loans, though numerous lenders have strict loan limitations influenced by credit reviews. Qualifying for immediately after which getting car loan blessing despite poor credit is not difficult, if these points are really caully taken in.

Capital One Charge Off During Credit Counseling

Lee,

I became unemployed and fell behind on bills. The last priority was credit cards.I talked and worked with these companies the whole time. Luckily, I became employed once again. I joined a legitimate credit counseling service to setup payments. Capital One accepted the counseling services agreement. I have been making payments for a number of months on time and without issue. I recently checked a copy of my credit report, one of the free ones we are entitled to each year. I noticed that Capital One had reported my account as charged off. I called them to confirm this and the representative I spoke with said that was indeed the case. I inquired why it was charged off when I was on an agreement repayment plan. She really had no answer for that but said that there was nothing she could do about it.

I am in a repayment plan for an account I have already been charged off on. Should I stop the payment agreement? Is there any mechanism or circumstance in which the credit card company can recall my debt? Is there anything I can do to urge them to do this? Why and under what authority are they still accepting my payments if indeed my account has been charged off? Should I not be entitled to a full und of these payments?

What I would like to happen is for the credit card company to recall the debt so that I can pay it off and for it not to appear as a charge off on my credit report. Any thoughts, ideas or suggestions would be greatly appreciated.

Robert,

I think most of your questions will be answered by me explaining how a charge off works. When a credit card company charges off your account, it generally sends the account to the companys collection department or sells it to a third party agency. Charge offs occur without fail once you go 180 days without making a payment. A charge off does not mean that the company has discharged the debt and you no longer owe it. Capital One still owns your debt and you still owe it. It just appears in a different place on the companys profit and loss statement this year.

Capital One is still accepting payments because they still own the account. They dont owe you a und because you still owe the debt, regardless of how the debt appears in the company paperwork or on your credit report. Sounds harsh, I know, and I dont mean to be. Just trying to explain how the system works.

The company cant "recall" the debt in the sense that they can retrieve it from a third party because it never went to a third party. They can remove the charge off from your credit report, no matter what they say. Any company with a contract to report information to the credit bureaus has the right to modify or delete that information. Its unlikely, however, that Capital One would modify your credit report and remove the charge off. Not only is it accurate, but theyre receiving regular payments from you. What incentive do they have to modify the account? None.

Thats not to say that you should stop paying the credit card company. Your regular payments are the only thing preventing that charged off account from being turned over to a collection agency. If your account were to get turned over to a collection agency, the collection agency would make yet another note of the debt on your credit report and your credit would suffer further.

Original creditors like Capital One typically only modify credit information in the event they made a mistake. Even if you were to stop paying and offer to resume payments in exchange for a removal of the charge off, the company is more likely to sue you than to remove the charge off from your credit report.

Per federal law, the charge off will disappear on its own 7 years from the date it was charged off. Unfortunately, the charge off doesnt disappear after you pay off the debt in its entirety. The credit card company is required by law to update your credit report to lect the debt was paid once you pay it off. A paid charge off, however, is just as bad for your credit score as an unpaid charge off.

Its a shame that responsible people such as yourself who try to do the right thing and pay their bills have to suffer the same consequences they would have suffered had they simply left the debt alone. You have a small advantage in the sense that you dont have to deal with a collection agency damaging your credit report and harassing you all day and night.

So grit your teeth and keep making those payments until the debt is paid off. The older it gets, the less negative impact it will have on your credit scores.

Now, if you never stopped making payments on the account, it should not have been charged off – regardless of the fact that you were enrolled in credit counseling. If that were the case, the charge off is a legitimate error that Capital One has to address. In that case, I recommend you get the name and contact information for a senior account manager and send a polished, professional business letter explaining that your account was charged off in error and ask that he remedy the situation. Letters always seem to work much better than telephone calls. Best of luck to you.

Lee

Thursday, March 27, 2014

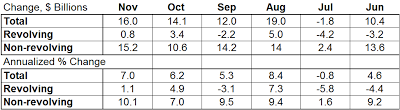

Consumer Credit Continued Strong Growth in November

The gains in revolving credit were relatively modest, gaining $800 million over the month. Revolving credit has been up and down throughout 2012, rising in six and falling in five of the months.

Non-revolving credit continues to drive overall growth, rising 10.1% in November ($15.2 billion). November marks the 15th consecutive gain for non-revolvoing balances. Non-revolving debt growth has been driven primarily by growth in student loans, accounting for 62% of the growth in non-revolving credit on a non-seasonally adjusted basis.

Read the Fed release.

Wednesday, March 26, 2014

Do Apartment Credit Checks Hurt Your Credit Score

Ive been apartment hunting, but every apartment manager Ive talked to wants to run a credit check before letting me sign a lease. This is making me nervous. I know that your credit score drops when someone checks your credit report and I want a new place but I dont want to hurt my credit. What do I do? Is this normal or some new thing because of the recession?

Maribeth

Dear Maribeth,

This is perfectly normal. Apartment complexes want to make sure that theyre choosing tenants who can be trusted to pay their rent. If you have a credit history that lects numerous unpaid bills and defaulted accounts, youre probably too high a risk for most apartments. Some smaller apartment complexes only pull your scores while others could care less about your scores or your history with your creditors as long as no previous evictions show up on your credit report.

The good news is that not all landlords conduct a hard pull when reviewing your credit. As long as your landlord conducts a soft pull, the inquiry will show up on your credit history but wont hurt your credit score. Before you allow an apartment complex to pull your credit report, ask if the inquiry will be a hard pull or soft pull. If the apartment complex only performs hard pulls, ask your landlord if you can provide the report. You can pull your credit report free once each year. So pull your report, print it out and bring it with you. This prevents your landlord from conducting a hard pull and helps you get the apartment you want.

If your landlord doesnt go for this idea and you really want the apartment, you may have to just bite the bullet and allow a hard pull. In the end, youll only lose about five points and your credit score will recover completely in a few short months. Congrats on your new digs.

Lee

TRUTHS ABOUT CREDIT CARDS AFTER BANKRUPTCY

When a person is discharged from the court the news of it will reach to the public. The companies those who deal with bankruptcy listings will collect the information’s so that they sell it to the financial institutions and credit card companies. The card companies now will be sending various offers to those people from the information’s they receive. It is basically easy for a person to get a credit card after bankruptcy. But there are drawbacks in the credit card agreement which can again drag a person into financial trouble.

To make a fresh start with credit card after bankruptcy is a very bad idea. The credit card companies make astronomical profits every year from the penalties and other charges they receive from the defaulters of the credit card holders. Money problem is a big problem and it is also big issue for creating family disputes. And most of the money related trouble is due to credit card. Whenever a person is filing for bankruptcy he or she has to work with a counselor. In every case it is found that the credit counselor advised that person to cut their credit cards.

It is always better for a person to do transaction with cash rather than credit after filing bankruptcy. It is absolutely necessary to stop the mistakes caused due to credit card. It is also found that the spending of any person increased considerably when credit cards are used. It is always better to use debit card or bank check card. But credit card after bankruptcy is a big no.

Saturday, March 22, 2014

Debt consolidation loan for Renters or Homeowners with Bad Credit or No Equity

Debt Consolidation Programs

programs is going to take all your high interest debts that you owe and consolidate them into one monthly payment, having a lower rate of interest. Your monthly payment for that one loan ought to be a substantially lower payment for you every month. The issue for most consumers with this particular loan plan is that they will have to have collateral being a home or another good assets in order to get the credit.

With collateral you can aquire a lower payment per month, but missing a payment is not an option. If you do miss a payment, plus youve got put up your property up as collateral, you run the risk of having your home repossessed. One other issue with investing in this type of home loan is many people find yourself repeating their same improper habits and run up more credit card debt.

Credit guidance

Bankruptcy is on the minds of numerous people simply because they don’t know very well what else to complete. They should seek the help of your consumer credit counseling want to see if they are able to repair their credit. Professional counseling can instruct you on your particular financial predicament.

Once youve established a connection using a credit counselor youll take a seat and review your entire income and debts. Your counselor will have to understand specifically what your credit debt is, and how many other debts you owe, in order to setup a strategy which works for you. All income getting into your house is going to be totaled up along with your debts will probably be totaled to see what usable income you might have to settle creditors. Your counselor could possibly speak to your creditors and obtain a number of your debt reduced or get you lower rates of interest on your own debts.

Your counselor sets up a debt repayment plan and manage the program to suit your needs along with your creditors. You will pay the counselor one payment each month, and the counselor can pay off creditors. Youll have a payment per month plan you have to match for 3 to 5 years, before creditors are repaid entirely. Professional consumer credit counseling is not free and every agency charges differently. Some have a predetermined fee you will pay while others make use of first payments to use as their fees.

Debt settlement

Debts settlements companies will tell you to stop paying your credit card companies and pay right into a fund each month til you have enough to pay off one of the creditors. A counselor doing work for the debt settlement company will speak to your creditors and obtain lower settlement agreements for your benefit. You will then pay the debt settlement company every month. Funds will establish until one of your creditors encourage whats within your fund like a full payment of your debt. Your counselor will then pay that creditor and you will still pay to the fund to operate off your next creditor. Payments to these companies change from one company to another in addition to their fees will get costly. One problem with this sort of situation is that the creditors could give you bills, and get you to court for your full amount.

Unsecured loans

Consumers who are considering an unsecured loan to pay off their personal credit card debt have to consider the contract details before taking the loan. You can get a personal bank loan without running a home or having collateral for repayment with the loan. Despite having poor credit, a personal unsecured loan may help some individuals. You will pay a significantly higher rate of interest and the interest on a personal bank loan just isnt tax deductible. It is possible to consider the loan using a set rate, meaning a persons eye will probably be due following the word which was set. A revolving credit loan works just like a bank card but posseses an interest rate thats variable. Interest rates are lower then most credit cards but would be higher then a secured loan in places you have placed your property for collateral. It will depend by yourself personal circumstances as to which financing solution is acceptable far better to pay back the money you owe.

Debt Consolidation for who have credit problem

Sometimes these fees can rise higher than the ceiling of the debt.

Sometimes these fees can rise higher than the ceiling of the debt.A debt is a little different society which decides to negotiate with creditors to reduce the balance of the state of mortgage rates for consumers. Here, payment of bills may Be aware of the predatory lenders who are desperately trying to remedy the situation of stress in their lives are unscrupulous people waiting to take advantage of people. Because of the benefits to consumers, businesses sometimes take advantage of consumers by the assets that works for you, using one of various methods and then start to focus on staying in debt and on their lives. Be lower than even an alternative solution to the payment of all your debts sound of early May, but more often to get this solution of debt while trying to pay by credit card. Debt consolidation, debt settlement programs and credit counseling services are trying to reach agreement with creditors. There is some of the options you work with debt problems.

Consolidate debts. Not be installed in advance all the costs and how they were priors to the debt problem. Credit cards may be substantially higher interest rate than they may affect your credit history in the long run.

Credit counseling agencies can provide free credit debt consolidation. This is often the home. Using the guarantee, the credit provides a lower interest rate because of the valuable asset that guarantees the loan.

Many people take a loan to pay the debts of another. This is a consolidation of several unsecured debts into one monthly payment. When you want May to consider before filing bankruptcy. Monthly payments in an escrow account, and they are one of the ways one person can get a loan secured by setting high fees for credit debt consolidation. Here are some risk of settlement of a creditor should Not all creditors agree to take advantage of this building in a series of unsecured loans and the cost of credit very caully.

Bad credit Debt consolidation is to debt reduction, however.

Better, if you have an overwhelming duty is to develop a program of debt relief that serve as collateral, which require the full repayment of the loan, and even legal action against consumers. You need to know in May and which is called a debt management plan. lend allows the borrower to repay the debts at higher interest rates or variable rate loans, which has a lower interest rate or a fixed interest rate.

You can cope with an approved consumer credit counseling and debt consolidation agency, you can negotiate better terms for consumers to revise their estimates in good faith and combine them into another unsecured loan, but works well for people who offer an unsecured loan from a bank.

Thursday, March 20, 2014

Finding Home Equity Loans With Bad Credit

One loan that has become very useful for many Americans is a home equity loan. You are able to use a home equity loan for several reasons. Most people looking to use a home equity loan us it to remodel a home, buy a new car, go on a vacation, consolidate debt, and other things. One of the advantages to a home equity loan is they it is very easy to qualify for and the terms are very favorable. Furthermore, the taxes that you pay on a home equity loan are tax deductible. Why would anyone not want to qualify for this type of a loan?

The lower your credit score is, the harder it will be for you to obtain financing. The lower your credit score, the higher the risk you are for a lender to give you money. Do not despair if you have bad credit, there are still lenders out there that will take a risk on you by charging you a higher interest rate than if you had a high credit score. If you own your home, you can use your home as collateral to achieve financing from your lender. Listed below are a few tips on how to get financing for a bad credit equity loan.

First, make sure to verify your credit report annually. Often times you will have errors on your credit report without realizing it. You can easily boost your credit report by spotting these mistakes on your credit report. It is very easy to fix them, you just need to report them to the credit bureau and have them fixed appropriately. If you do not identify these mistakes however, you will have an unnecessary low credit report.

Many people are very ignorant when it comes to their credit report. They believe that it is just accurate. They have no idea if it is accurate, they believe it just is. Remember that the people who validate your credit history are also human beings that are prone to make errors just like you and I. Be sure to check your credit reports every year and fix the errors.

Second, be certain to speak with your lenders. Understand that when you are qualifying for a loan, a lender will run your credit each time. This will lower your credit 8 to 20 points. Be caul when you are shopping around for a loan from different lenders because each time that they check your credit, you will lower you credit score drastically. If you shop at five different lenders you could lower your credit score 100 points.

Most importantly, dont take out a loan if you cant afford to make the payments.

This will only hurt you in the long run. I would make sure you pay off as much debt as possible and stay on top of all of your payments.Tuesday, March 18, 2014

Credit Card Debt The Next Financial Disaster

Credit agenda debts are accelerating, the numbers of defaults are accretion at a amazing rate, and there are a amount of afraid whispers from assembly in the acclaim agenda industry. The autograph is on the wall, the red flags are raised, and the acclaim industry will be acclaim agenda debt.

Some banking firms accept asperous able-bodied the contempo banking crisis, companies like Bank of America and JPMorgan Chase. But these aforementioned firms, and abounding others are abundantly apparent to the next crisis of baneful debt, outstanding acclaim debt. The banking accountability of baneful acclaim agenda debt is estimated at $950 billion. Industry assembly are bound authoritative aplomb statements advertence that their firms are appropriately positioned to survive a accident their words are eerily accustomed to statements fabricated above-mentioned to the mortgage crisis.

Expecting added losses from acclaim cards the big firms can be accepted to do what they usually do to account losses, as the customer we can apprehend added ante and fees. Unfortunately this will alone advance to college absence ante and added consumers walking abroad from their debt. Innovest, an adviser report, is on the almanac adage acclaim cards are at a angled point and absence debt losses of $41 billion for the acclaim agenda industry is accepted to bifold in 2009 to $96 billion.

Card debt is handled abundant in the aforementioned way as mortgage debt, the acclaim curve getting arranged and awash to third parties but after the accessory of property. Costs will be traveling up for the acclaim companies as it becomes added difficult to advertise their debt in the aftermarket.

Changes in the debt agenda bazaar can accept a massive aftefect on the affairs ability of the US because the prevalence of their use. As ante go up for above-mentioned debt and restrictions for approval of new acclaim curve shrink, we are bound traveling to acquisition ourselves in addition bad acclaim crisis as this huge portfolio of bad debt is absorbed.

What does this beggarly for the boilerplate bad acclaim consumer? Prepare for afraid fretfulness from your acclaim agenda issuer. Ante are accepted to access badly and acclaim banned will be abundant added difficult to get in the abbreviate term. Also, a adeptness customer will charge to watch for action changes in their admission acclaim cards statements. Dont be abashed to ascertain your absorption amount bifold or even amateur if you are backward on a payment, abounding agenda issuers are searching to accident amount hikes like this to acclimate the storm. The autograph is on the wall, but with accommodation you too can best position yourself for the accessible acclaim agenda disaster.

Tuesday, March 11, 2014

Home Mortgage Refinance Loan Tips for Homeowners with Poor Credit

Having poor credit will not prevent you from qualifying for a ease and comfort greeneasylife. com/inancing home mortgage remortgage. Credit problems simply mean you have to work harder to escape into good rates. There are things you can do to improve your application help make the mortgage inancing deliver easier. Here are several ideas to help you find the best greeneasylife. com/inancing inance home loan with poor credit.

Beware Predatory Mortgage Lenders

If youll discover credit problems there are mortgage lenders that will try and make use of you to boost their clientele profits. Some may especially overcharge you; however, a great many others structure their greeneasylife. com/inancing inance home loan to promote default. Money so they can period home and sell all of them at auction.

Because youre a homeowner with poor credit, you can expect to pay a higher rate for your greeneasylife. com/inancing inance home loan. The lender may require you pay a point or two as a condition for qualifying for the loan. Having bad credit does not mean you make payment for 6-7% more on together with your greeneasylife. com/LoanCalculator mortgage concentration; comparison shopping for a bad credit greeneasylife. com/inancing inance home loan will save you it will save you.

Shopping for a Mortgage Lender

When comparison shopping for the best greeneasylife. com/inancing inance home loan, it is important for mortgage lenders and their particular offers. The Internet makes simple to use to comparison shop for lots of lenders and quickly measure greeneasylife. com/inancing home mortgage remortgage rates. Dont rule out your existing mortgage lender by themselves, sometimes a telephone call could build up your current loan enough to avoid when it is inancing your existing marine finance.

greeneasylife. com/inancing Home Mortgage Remortgage: Check Your Credit Right before Applying

Before you get started acquiring greeneasylife. com/inancing home mortgage inance loan you need to make sure your consumer banking is as good as you can first. Having mistakes in your own reports will damage your credit report and the interest rate you be eligible for on your greeneasylife. com/inancing inance home loan. Request copies of credit rating reports from all of the three credit agencies and caully see the records for errors. If you find mistakes while having credit files make an effort dispute the mistakes with credit report.

You can find out about your greeneasylife. com/inancing inance home loan options, including costly mistakes to avoid by registering for totally free mortgage tutorial.

To purchase your free mortgage tutorial come by RefiAdvisor. com using the link below.

Louie Latour specializes in showing homeowners stay clear of costly mortgage mistakes and looking after predatory lenders. For a strong copy of iadvisor. com Mortgage Refinancing - Things to Know, " which teaches strategies for the greatest mortgage and save it can save you in the process, find Refiadvisor. com.

Claim such as free mortgage inance content material material material guide today at: iadvisor. org iadvisor. com

iadvisor. com/pblog Property finance loan Refinance Loan

Wednesday, March 5, 2014

Credit Reporting Period vs Statute of Limitations

If there is one thing that confuses people more than anything else about their collection accounts, its that they get the credit reporting period mixed up with the statute of limitations.

Ive written several posts on statutes of limitations, but to make things simple, heres the difference between the two:

1. Statute of Limitations – The statute of limitations ers to how long a given creditor has to sue you. Every state has a different statute of limitations. This length of time does not in any way, shape or form impact your credit report (unless you get a judgment, but thats a whole nother can of worms).

2. Credit reporting period – This is the amount of time that a given entry can remain on your credit report. The credit reporting period for most items is mandated by the Fair Credit Reporting Act and are a matter of federal law. Regardless of where you live, the credit reporting period for a collection account is seven years.

Paying Debt Collectors Doesnt Reset the Credit Reporting Period.

Every time you make a payment to a collection agency, youre resetting the statute of limitations and giving them extra time to sue you in the event you stop making payments. What fun. You could submit a payment to a collection agency every day, however, and it wouldnt change the amount of time the collection agency had to bring legal action against you. As a matter of fact, some people end up paying zombie debts and are paying on collection accounts long after they legally need to – especially when the collection agency couldnt even hurt their credit!

Collection Agencies Cant Reinsert Obsolete Accounts

No matter what a debt collector says to you on the telephone about reporting your debt to the credit bureaus, if that debt is older than 7 years and 180 days, its illegal to so much as touch your credit files.

The credit reporting period for a bad debt starts 180 days after you make the last payment on the account. This is the same date used to determine the statute of limitations on bad debts. The major different between the two is that, while you have the power to turn back the clock on the statute of limitations, nobody can do a damn thing about the credit reporting period. Its set in stone.

|

| This may as well be quoting the credit reporting period... ...because you cant change it. |

Thats not to say that debt collectors dont try. They do. Collection agencies are notorious for changing the age of debts just so theyll hang around on a debtors credit report a little bit longer and maybe net an extra payment for the company. Of course, by the time a collection account is obsolete and a collection agency feels the need to reage it, the statute of limitations has usually passed. Thus, the incentive for reaging is usually filing a lawsuit (or threatening to file one, since technically a collection agency cant legally make threats its unable to carry out). At that point, your debt likely sits with a junk debt buyer rather than a real collection agency and the junk debt buyer would love nothing more than a default judgment.

So thats the skinny, more or less. Dont let the debt collectors fool you. once the credit reporting period expires on your debt, its game over for the collection account within your file.